Garmin watches are trusted by millions, but do you really know where and how they’re made? This article breaks down Garmin‘s entire manufacturing and supply chain strategy.

Garmin watches are primarily made in Taiwan, accounting for over 95% of global production, including high-end models like Fenix and Enduro. Some entry-level units may be manufactured in China.

Garmin’s vertically integrated production model1 ensures quality but introduces major risks. Let’s explore the structure and vulnerabilities of Garmin’s global supply chain.

What are Garmin’s supply chain pain points2?

Garmin’s strength lies in Taiwan. But this reliance can easily become a weakness.

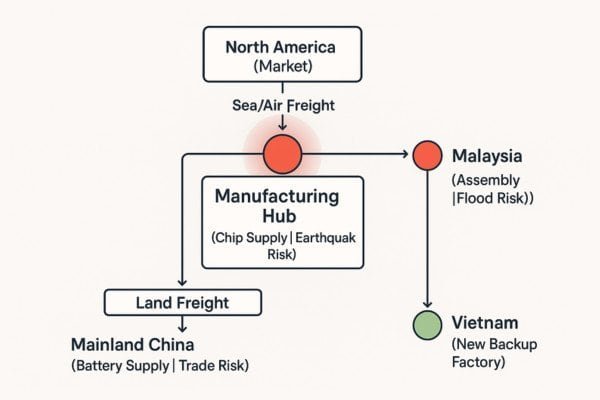

Garmin’s supply chain is highly centralized in Taiwan, creating exposure to geopolitical risks3, limited cost flexibility4, and slower response times.

Manufacturing Footprint Overview

| Region | Facility Location | Production Share | Product Line | Automation Level |

|---|---|---|---|---|

| Taiwan | Tainan Tree Valley | >95% | Fenix, Enduro | High |

| Taiwan | New Taipei (rumored Kaohsiung) | Unconfirmed | Logistics/Auxiliary | Medium |

| Mainland China | Undisclosed | Minor | Entry-level models | Moderate |

Key Component Sources

| Component | Likely Suppliers | Notes |

|---|---|---|

| GPS Chip5 | Airoha (MediaTek), TSMC | Used in Fenix 7; previously Sony, now back to Airoha |

| Optical HR Sensor6 | Maxim Integrated, Texas Instruments (speculated) | Not publicly disclosed |

| Environmental Sensors7 | Bosch Sensortec, InvenSense (speculated) | No confirmed source |

| Battery | LG, Samsung SDI, Panasonic (likely) | Lithium-ion, no disclosed brand |

| Display (MIP) | Sharp, JDI | Used in low-power outdoor models |

| AMOLED Display8 | Samsung Display (likely) | Found in Venu series |

Logistics Network

| Destination | Port of Origin | Destination Port |

|---|---|---|

| Europe | Kaohsiung/Tainan | Rotterdam, Hamburg |

| North America | Kaohsiung/Tainan | Los Angeles, Long Beach |

Delays may occur due to geopolitical events, such as the Red Sea crisis in 2025, which affected global freight timelines and costs.

What are the 5 major risks in Garmin’s supply chain?

Even strong systems have weak spots. Here’s where Garmin’s supply chain faces real challenges.

1. Geopolitical Concentration Risk1

95% of Garmin’s production comes from Taiwan. Political tension in the Taiwan Strait could cripple its supply chain overnight.

2. Rigid Cost Structure2

Taiwan’s labor, electricity, and land are expensive. Competing with low-cost manufacturers becomes harder.

"SMT line labor in Taiwan costs \$6.2/hr vs. \$3.8/hr in South China, driving a 12% delta in overall labor BOM." (Statista 2024)

3. Limited Supply Chain Resilience3

Key components like GPS chips and sensors rely on a small number of suppliers. A disruption in Japan or Taiwan can halt production.

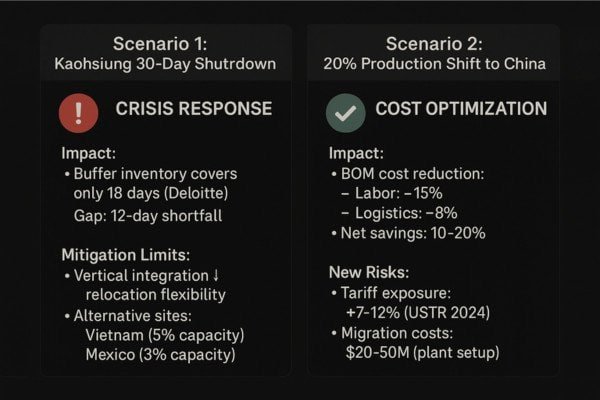

"Simulations show Garmin can only cover 18 days of global demand if Kaohsiung port halts for 30 days." (Deloitte SCM model)

4. Slower Response Time

Garmin’s vertically integrated model adds lead time. Compared to OEMs in South China, they might be 2–4 weeks slower in delivery.

5. Tariff Exposure

Though "Made in Taiwan" enjoys favorable tariffs, key components from China may face new duties. This pushes BOM costs higher.

How can Garmin’s supply chain teach new watch brands?

Let’s walk through realistic planning scenarios to learn from Garmin’s experience.

If Kaohsiung stopped for 30 days, Garmin would likely rely on buffer inventory, but struggle to shift production due to Taiwan’s dominance.

If 20% of production moved to China, BOM costs could drop by 10–20%, but tariffs and migration costs need balancing.

Component Localization Options

| Original Component | China Local Alternative | Performance Delta |

|---|---|---|

| Maxim HR Sensor | GoerTek Optical Module | ±3 BPM |

| Samsung AMOLED Panel | BOE / Tianma AMOLED | 5% lower brightness |

| Japanese Sealant | Huitian Industrial Glue | Same IP68 rating |

"Taiwan Design + China Production" in Practice

While Garmin hasn’t publicly confirmed this model, many second-tier electronics brands already apply it to balance cost and quality. This approach uses Taiwan for design and QA, but China for mass production.

| Region | Role | Benefits |

|---|---|---|

| Taiwan | Design & Validation | Quality, innovation |

| Mainland China | Manufacturing | Cost-efficiency, fast scaling |

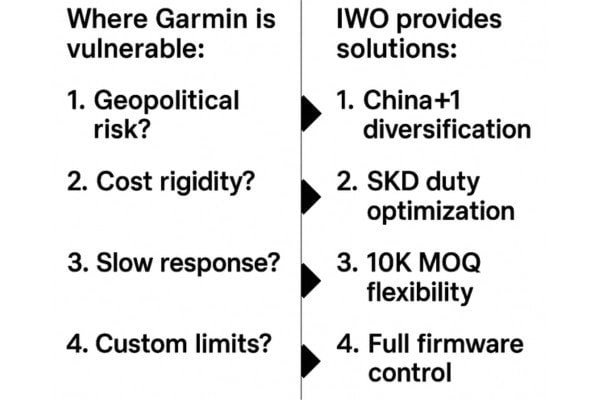

What ODM solutions9 does IWO offer?

If you’re building an outdoor watch brand, learning from Garmin is just step one. Implementing it is where we come in.

IWO offers “China+1” and SKD shipment models, OEM/ODM flexibility, and customization at scale—from mold to firmware.

Our ODM Offer with Execution Metrics

| Model | MOQ | Lead Time | Key Advantage |

|---|---|---|---|

| Full ODM | 5,000+ | 90-120 days | Own ID/firmware, full control |

| OEM | 500+ | 30-45 days | Fast entry, low cost |

| OEM-ODM Hybrid | 5,000+ | 60-75 days | Tailored function + cost saved |

| SKD Delivery | 5,000+ | 35-50 days | Local assembly savings |

| China+1 Strategy | Custom | Based on config | Regional diversification |

Client Results Snapshot

A Nordic outdoor brand reduced Fenix-equivalent BOM by 22%, and launched mass production in 12 weeks using our ODM plan.

Summary

By analyzing Garmin’s deeply integrated yet risk-exposed supply chain, we uncover key takeaways for emerging smartwatch brands. Taiwan’s dominance in Garmin’s production ensures quality but invites vulnerability. Our comparison shows that China-based ODM models offer compelling cost and speed advantages. With insights from component alternatives, cost breakdowns, and real-world execution metrics, new brands can make smarter sourcing decisions faster.

-

Explore how vertical integration can enhance quality and control in manufacturing. ↩ ↩

-

Identify key challenges in supply chains and how to address them. ↩ ↩

-

Understanding geopolitical risks can help businesses mitigate potential disruptions. ↩ ↩

-

Learn strategies to enhance cost flexibility and competitiveness in manufacturing. ↩

-

Find out about the top suppliers and innovations in GPS chip technology. ↩

-

Explore the latest advancements in optical heart rate sensor technology. ↩

-

Learn about the various types of environmental sensors and their uses. ↩

-

Explore the advantages of AMOLED technology in display screens. ↩

-

Learn about ODM solutions and how they can benefit product development. ↩